Make it regular: the benefits of regular investing and dollar-cost averaging

An insight from us to you.

Shopping - love it or hate it, everyone appreciates a bargain. You certainly don’t see people camping outside department stores when they raise their prices, do you? But if you look at the way many people invest, that’s exactly how we behave. Everyone wants a piece of the action when markets are booming – largely because of a fear of missing out. Then when markets are down, many investors run for the hills, putting their money somewhere more ‘safe’ until the downturn is over. However, trying to time your investments is notoriously difficult and sometimes the best time to invest probably feels like the worst. With markets so hard to predict, it pays to spread your investments over time.

The power of regular investing - Each time you make an investment in a managed fund you are purchasing units in the fund. The price of each unit is determined by the underlying assets the fund invests in. So when investment markets are rising, unit prices will often increase. Conversely when investment markets are down, unit prices will often decrease. Dollar-cost averaging simply means investing at regular intervals, and averaging out the cost of the units you buy in the fund over time. The following case study shows you the difference between dollar-cost averaging and trying to time a one-off investment.

The benefits of regular investing

Avoid timing the market. Trying to pick the top or bottom of markets is notoriously difficult. Regular investing helps ensure you don’t miss out on the best gains.

Smooth the ride. Markets fluctuate, by investing regularly you help to reduce the impact of periods of short-term volatility.

Long-term rewards. Regular investing gives your money the time it needs to grow, as markets will generally increase over the long term.

Case study: a tale of two investors

The graph to the right shows the movement in the unit price of a managed fund over a 10 month period.

Encouraged by reports of a strong market, Eager Eric decides to invest after six months. His $100,000 investment buys him 98,039 units in the fund at $1.02 each. Instead of a one-off investment, Dollar-cost Danni chooses to invest $10,000 every month over the same period. Each month, as the unit price fluctuates, the $10,000 buys a different amount of units in the fund.

The table shows the value of the investments over the 10 months.

By buying consistently over the year Dollar-cost Danni ended the 10 months almost $6,000 better off than Eager Eric. This example shows that trying to time your investments is notoriously difficult. One of the important tips to sound investing is to spread your investments over time.

It pays to get in early

One of the best allies for any investor is time. The longer you invest, the more time you have to ride out periods of market volatility. More time in the market also helps you harness the power of compound returns, as demonstrated in the following

Case study: the long and the short of it

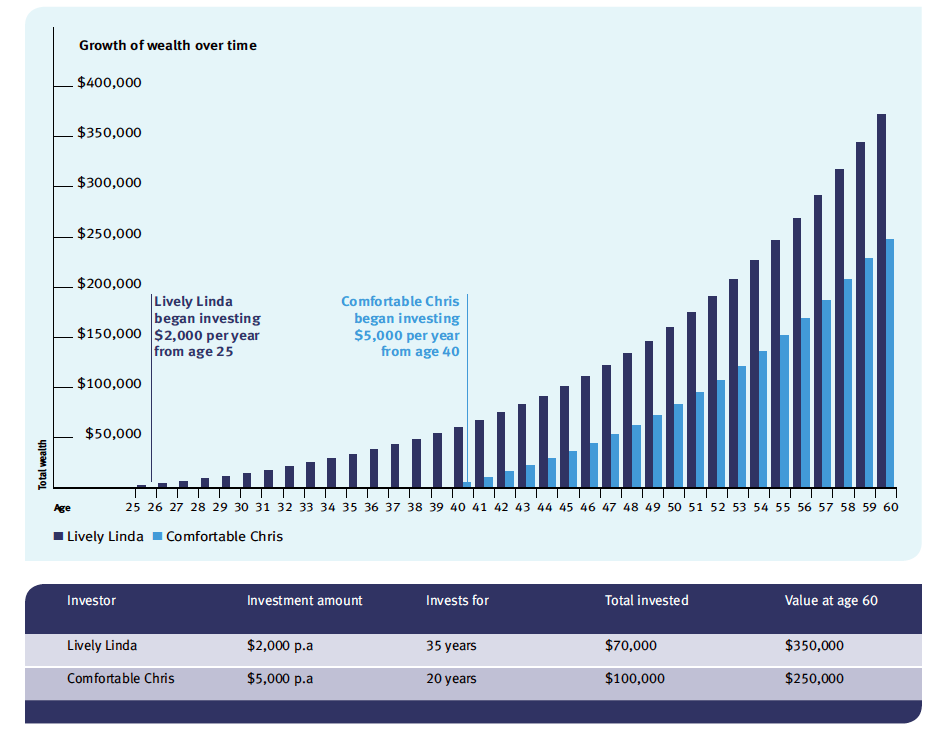

Lively Linda is a keen investor. From the age of 25 she invests $2,000 p.a. in a managed fund, earning an average of 8% p.a. Comfortable Chris doesn’t start investing until he turns 40 years of age, at which point he invests $5,000 p.a. in a managed fund, also earning 8% p.a. Linda and Chris both retire at age 60. Let’s take a look at how their wealth grows over that time in the graph and table to the right.

Even though Linda invested $30,000 less than Chris in total, the value of her investment at age 60 is $100,000 higher. This shows the benefit of starting early, and allowing your money more time to grow.

Assumptions: Calculations do not take taxation into consideration and assume both investors earned 8% p.a. and all investment returns are reinvested.

The results may vary if different dollar amounts are invested and if the return earned is higher or lower than 8% p.a. at different times.

In summary

Regular investing is a powerful and disciplined way to build wealth, and the sooner you start the better. With time on your side you can ride out the short-term volatility of investment markets, and avoid the pitfalls of trying to time the market.